9.13.18

The cost of caregiving

About 40 million family caregivers in the United States provide unpaid care to another adult.1 Caregiving for a loved one is a noble endeavor, and considering the high cost of professional long-term care, it may be the only alternative for some families. But “free” caregiving often comes with financial, physical, and emotional costs. If you are a family caregiver, or know someone who is, here are some suggestions to consider.

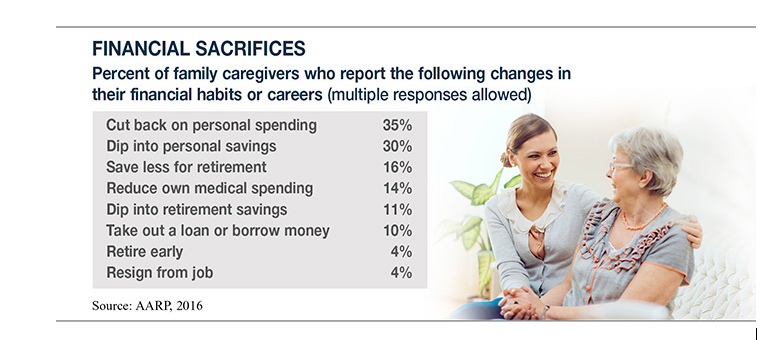

Preserve your own assets. More than three out of four caregivers incur out-of-pocket expenses, with average spending approaching $7,000 annually. Expenses can be even higher when the person being cared for requires longer hours of care, needs help with more daily activities and/or medical/nursing tasks, is suffering from mental illness or dementia, or lives at a distance from the caregiver.2

Although it’s generous to help an aging parent or other relative financially, be realistic about your own present and future financial needs. It might make more sense to spend down an older person’s assets, which could reduce the taxable estate and/or qualify him or her for long-term care benefits under Medicaid.

Take advantage of available benefits. Make sure the person you are caring for has all the benefits to which he or she is entitled. The Eldercare Locator (eldercare.gov), a public service of the U.S. Administration on Aging, and the Benefits CheckUp website (benefitscheckup.org) from the National Council on Aging are helpful places to start.

Talk to your employer. One out of three caregivers has changed work hours and 20% have reduced work hours; 22% have taken unpaid leave.3 Many companies include family care in their sick-leave policies, and you might be eligible for up to 12 weeks of unpaid leave under the Family and Medical Leave Act.

Educate yourself. Make sure you fully understand your loved one’s condition, medications, and appropriate methods of care. Ensure that you are authorized to speak to physicians and health providers regarding the patient’s treatment plan. Don’t hesitate to call with questions, and keep a running list of issues for the next office visit.

Take care of yourself. Many caregivers suffer from physical or mental conditions that are caused or exacerbated by the strain of providing care. Take regular breaks to rest or enjoy a favorite activity. Ask for help from other family members and friends. Consider support groups. Don’t be afraid to seek professional help for yourself.

More information on family caregiving is available from the Family Caregiver Alliance (caregiver.org), the Caregiver Action Network (caregiveraction.org), the National Institute on Aging (nia.nih.gov), and AARP Caregiving (aarp.org/caregiving).

1–3) AARP, 2016

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2018 Broadridge Investor Communication Solutions, Inc.

* Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Consumers Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.