9.14.17

Changing jobs? Careful with your 401(k)

U.S. workers change jobs every 5½ years, on average.1 These changes often include a very important decision regarding the assets in their former employer’s 401(k) or other defined-contribution plan. Unfortunately, about 45% of people cash out their balances in workplace plans when changing jobs, and the percentage rises to 55% for those with balances of $5,000 or less.2

When you take a distribution from your 401(k), you will owe ordinary income tax on the withdrawal and possibly a 10% early-withdrawal penalty if you are under age 59½. The biggest penalty, however, might be the loss of future retirement assets. Consider that even a $5,000 401(k) balance could grow to more than $30,000 over 30 years, assuming a hypothetical 6% annual growth rate.3 Cashing out a larger balance would have larger consequences.

Preserving Tax-Deferred Savings

Depending on your situation, you may have several other options for your 401(k) assets when changing jobs. All of them generally preserve the tax-deferred status of your retirement funds and offer the potential for continued tax-deferred growth.

Keep assets in former employer’s 401(k). This could be a convenient short-term option (if allowed by your former employer), but you will not be able to make future contributions. Keep in mind that many employer plans may automatically transfer balances under $5,000 to an IRA and automatically cash out balances under $1,000.

Transfer assets to a new plan. If your new employer offers a 401(k) or other workplace retirement plan that accepts rollovers, this strategy might make sense if you are comfortable with the fees and investment options in the plan and expect to stay with your new employer for some time.

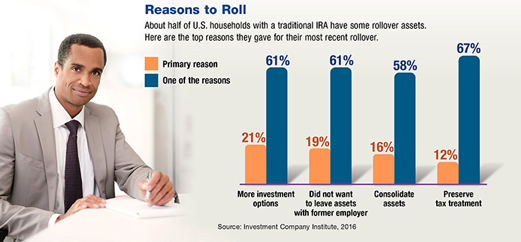

Roll assets to an IRA. IRAs typically provide a wider variety of investment options than employer plans and enable you to consolidate your retirement assets in a single account. Moreover, the IRA is yours to control, regardless of your employment situation.

For either type of rollover, it’s more efficient to execute a trustee-to-trustee transfer from your old plan to the new plan (or IRA), either directly or in the form of a check made out to the new trustee. If you receive a check payable to you from your former employer’s plan, 20% will be withheld for federal income taxes. You have 60 days from the date of the check to roll over the entire distribution — including the tax withheld — to an IRA or another employer-sponsored plan; otherwise, the amount not rolled over will be considered a taxable distribution.

Distributions from traditional IRAs and most employer-sponsored retirement plans are taxed as ordinary income. Withdrawals prior to age 59½ may be subject to a 10% federal income tax penalty, with some exceptions.

1) Employee Benefit Research Institute, 2015

2) InvestmentNews, February 17, 2015

3) This hypothetical example of mathematical principles is used for illustrative purposes only and does not represent the performance of any specific investment. Fees and expenses are not considered and would reduce the performance described if they were included. Actual results will vary.

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright 2016 Emerald Connect, LLC.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Consumers Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.